Read the latest issue of Equistone News to learn more about the portfolio companies' buy and build strategies, SF-Filter's growth story and the ESG champion BOAL. Likewise, there is news from our firm. Enjoy your read!

Yours

One of the central pillars of the Equistone funds investment strategy is the balance and sector diversification of the portfolio – which ranges from business services, TMT, consumer and healthcare companies, to industrial and technology businesses. Through this sector-focused approach, we have been able to continuously expand our deep understanding of these different industries and our strong network within each sector. In addition to enabling successful collaboration with the portfolio companies across different markets, this has also allowed the funds to deliver robust performance in difficult times while investing in new and promising companies.

In this vein, the Equistone funds added a new player in the business services sector to its portfolio at the beginning of the year with the acquisition of a majority stake in BUKO Traffic & Safety, a leading provider of outsourced traffic and safety management solutions in the Netherlands. Only a short time later, the exit of Amadys was signed. Following a successful partnership of more than three years, the Belgian infrastructure network specialist has been taken over by Netceed (former ETC Group).

A lot has happened within the portfolio in terms of international growth as well. With the acquisition of a majority stake in the two sister companies WCA Walldorf Consulting and target Software Solution, the IT service specialist TIMETOACT GROUP entered the US market and the consulting business for cloud-based SAP solutions. The Dutch portfolio company Andra Tech Group significantly expanded its presence in its home market and in Germany with the acquisitions of DKH Metaalbewerking and metal precision specialist Mayer Feintechnik. Sihl, an international supplier in the globally growing digital printing market, caught attention with an add-on acquisition and the further expansion of its US business.

Read the latest issue of Equistone News to learn more about the portfolio companies' buy and build strategies, SF-Filter's growth story and the ESG champion BOAL. Likewise, there is news from our firm. Enjoy your read!

Yours

BUKO Traffic & Safety (“BUKO”), comprising the business units BUKO Infrasupport and BUKO Waakt, is a leading provider of outsourced, customised traffic and safety management solutions in the Netherlands. The business became part of the Equistone portfolio in February 2023. BUKO currently employs more than 350 employees and generates an annual turnover of around 70 million euros.

BUKO Infrasupport specialises in end-to-end outsourcing solutions in temporary traffic management. Its comprehensive portfolio of services ranges from design, planning, approval, deployment and collection to the management of necessary road signage and safety equipment for on-site road works. The business primarily serves contractors in the construction industry and public authorities involved in utility-related as well as urban and rural road works.

BUKO Waakt specialises in temporary security solutions focusing on camera surveillance, intrusion detection systems and access control systems, particularly those used on construction sites for residential and public buildings.

Together with the management, Equistone’s aim is to capitalise on the strong market dynamics to further expand BUKO's market presence in the Netherlands and to expand into the neighbouring countries.

Several strategic acquisitions (most recently, Hungarian company RayNet), expanding its presence in its home market and developing important new core markets such as the DACH region, Central Europe and the UK: after more than three years of partnership, Equistone has announced the successful exit of Belgium-based Amadys. In early March, the Equistone funds signed the sale of their majority stake in the system integrator for end-to-end connectivity solutions in the telecommunications, infrastructure and energy industries to French-based Netceed. The merger with Netceed marks an important milestone on the way to becoming a global, industry-leading and multi-billion-dollar telecommunications provider.

The latest Gold Award in the ecovadis Sustainability Rating shows that Amadys knows how to act not only economically, but also sustainably. You can learn about the highlights of the partnership and the growth story behind Amadys in our Platform+ Magazine.

The Dutch Andra Tech Group, a leading group of companies dedicated to the manufacture of precision mechanical components, has successfully completed its first two acquisitions since our partnership began in March 2021.

With the acquisition last December of Mayer Feintechnik, a specialist in precision metal processing, the group strengthened its portfolio in the field of metal precision components and simultaneously laid an important foundation stone for further growth in the highly attractive German market. Only two months later, the acquisition of DKH Metaalbewerking, a highly specialised manufacturer of complex metallic parts and components, expanded the company's presence in the Dutch domestic market.

The two acquisitions mark the start of Equistone’s joint strategy with the executive management team (find an interview here) to further expand the capacities and capabilities of the Andra Tech Group through inorganic growth.

The portfolio company TIMETOACT GROUP, a leading digitisation expert and provider of IT services and consulting, has also been very active, recording its fourth and fifth successful acquisitions since the beginning of our partnership.

WCA Walldorf Consulting and its sister company target Software Solution joined the group in February 2023. WCA Walldorf Consulting is an international consulting firm for SAP cloud solutions with offices in Germany, Latvia, the USA, Singapore and Malaysia. Combining process consulting, award-winning expertise and competence in a range of technical solutions, WCA is one of the leading SAP S/4HANA public cloud consultancies in Germany. In addition, WCA has in-depth expertise in IFRS-compliant SAP Lease Administration.

target Software Solution is the provider of the world's only software for idea and innovation management with SAP technology. For more than 25 years, it has enabled its customers to establish and maintain a productive culture of ideas and innovation.

With these two acquisitions, TIMETOACT GROUP is driving forward its joint endeavour to expand its service portfolio with high-quality consulting services for cloud transformation.

Sihl, a global supplier of printable media in the growing global digital printing market, has completed its second acquisition since Equistone’s investment in the business. With the majority acquisition of Visual Imaging Products last December, Sihl is continuing on its path to US market leadership, following on from the acquisition of Dietzgen Corporation at the end of 2021. Visual Imaging Products, based in Ontario, California, is a distributor of bond paper, signage media and reprographic products.

With this acquisition, Sihl is strengthening its business, especially on the West Coast of the US, through even better service and portfolio quality.

In April 2018 the Equistone funds acquired BOAL Group, the greenhouse specialist headquartered in the Netherlands. Since then, a lot has happened: with three acquisitions, the company has significantly expanded its solutions portfolio. When it comes to ESG, the manufacturer of aluminium roof and side wall systems for glass and foil greenhouses has also set ambitious goals: the company is continuously working to advance its ESG strategy. Focus areas include expanding its portfolio of products that enable positive climate impact, reducing own emissions, further improving the health and safety of employees, and responsible corporate governance. BOAL’s commitment to its ESG targets will allow the company to compete in a market environment facing rising energy prices, a shortage of skilled workers and international competition.

In the current issue of our international Platform+ magazine, Moritz Treude and Roman E. Hegglin share the details of this ESG success story.

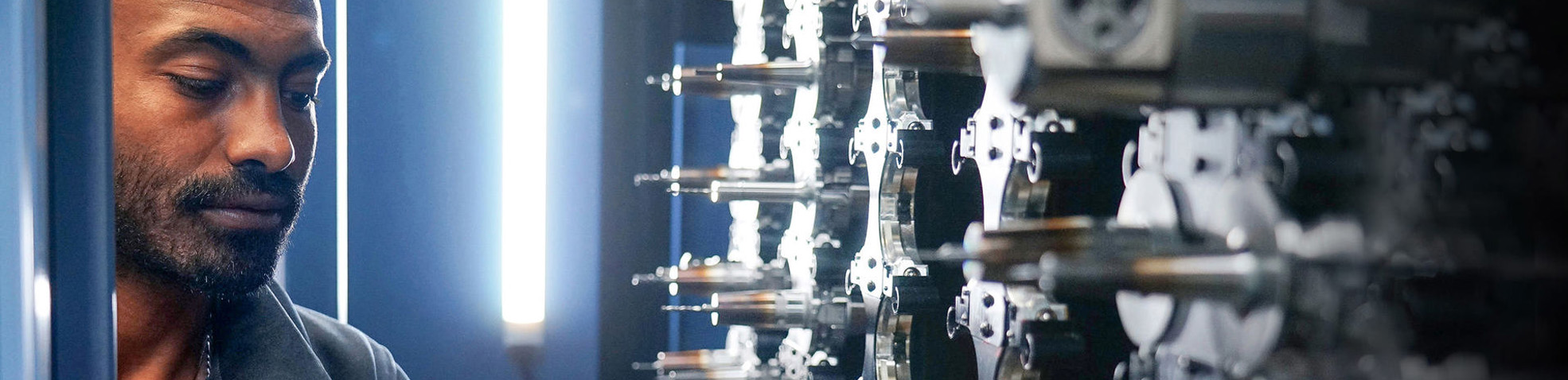

Since its foundation in 1968, SF-Filter AG has developed into one of Europe's leading one-stop distribution platforms in the fast-growing and resilient filter market. The company has an extensive product portfolio of mobile and industrial filters for a wide range of sectors, including air, fuel, hydraulics, oil, pneumatics and fluids. Last September, the company, based in Bachenbülach in Switzerland, became part of the portfolio, following an extended period spent tracking the business.

Roman E. Hegglin shares the whole story on Platform+.

We are pleased to have Finn Jankowiak join our Munich team. Finn returned to us as an analyst in November 2022, having previously interned at Equistone in 2021 and gained further experience at Perella Weinberg Partners, Bridgepoint and Fremman Capital in the interim. Finn's decision also shows us that our intern and student programme, which plays a central role in our talent search and development, is the right approach and is of value to both sides. Welcome “back”, Finn!

In addition, we are pleased to confirm the promotion of our Dutch colleague Josh Aalbers. Josh joined the DACH/NL country team in November 2021 and was promoted from Associate to Investment Manager in March. He most recently brought his years of investment banking experience, previously gained at Lazard, to our latest platform investment BUKO Traffic & Safety. Josh holds a MSc in Finance & Investments from Erasmus University Rotterdam and specialises in cross-border expansion in the Benelux market.

Not only in the DACH/NL region the Equistone funds have had a strong start to the year – in January, two successful exits were signed in the UK: After more than three years of partnership, the Equistone funds sold their majority stake in Acuity Knowledge Partners, a leading provider of high-quality research, analytics, and business intelligence software to the financial services sector in the UK, to Permira, a global private equity firm. Just previously, the sale of UK-headquartered Bulgin, a leading manufacturer of environmentally friendly, high-performance technical solutions, to Infinite Electronics, Inc. was successful. To top it all off, the leading and fast-growing B2B aggregator platform for vehicle rental Nexus Vehicle Rental, based in the UK, further strengthens Equistone funds’ business services portfolio.